This is the most comprehensive transcript. This transcript is available for the current tax year and returns processed during the prior three years. If you need the information from both the Tax Return and Tax Account transcripts, then get a Record of Account. When using Get Transcript by Mail or phone, taxpayers are limited to the current tax year and returns processed during the prior three years. This provides basic tax return data (marital status, adjusted gross income, taxable income) along with listing the activity on a tax account, such as tax adjustments, payments, etc., for the current year and up to ten prior years using Get Transcript Online. This transcript is available for the current tax year and up to 10 prior years. If you or the IRS adjusted your tax return after filing, a Tax Account transcript includes these changes. When using Get Transcript by Mail or phone, the primary taxpayer on the return must make the request.

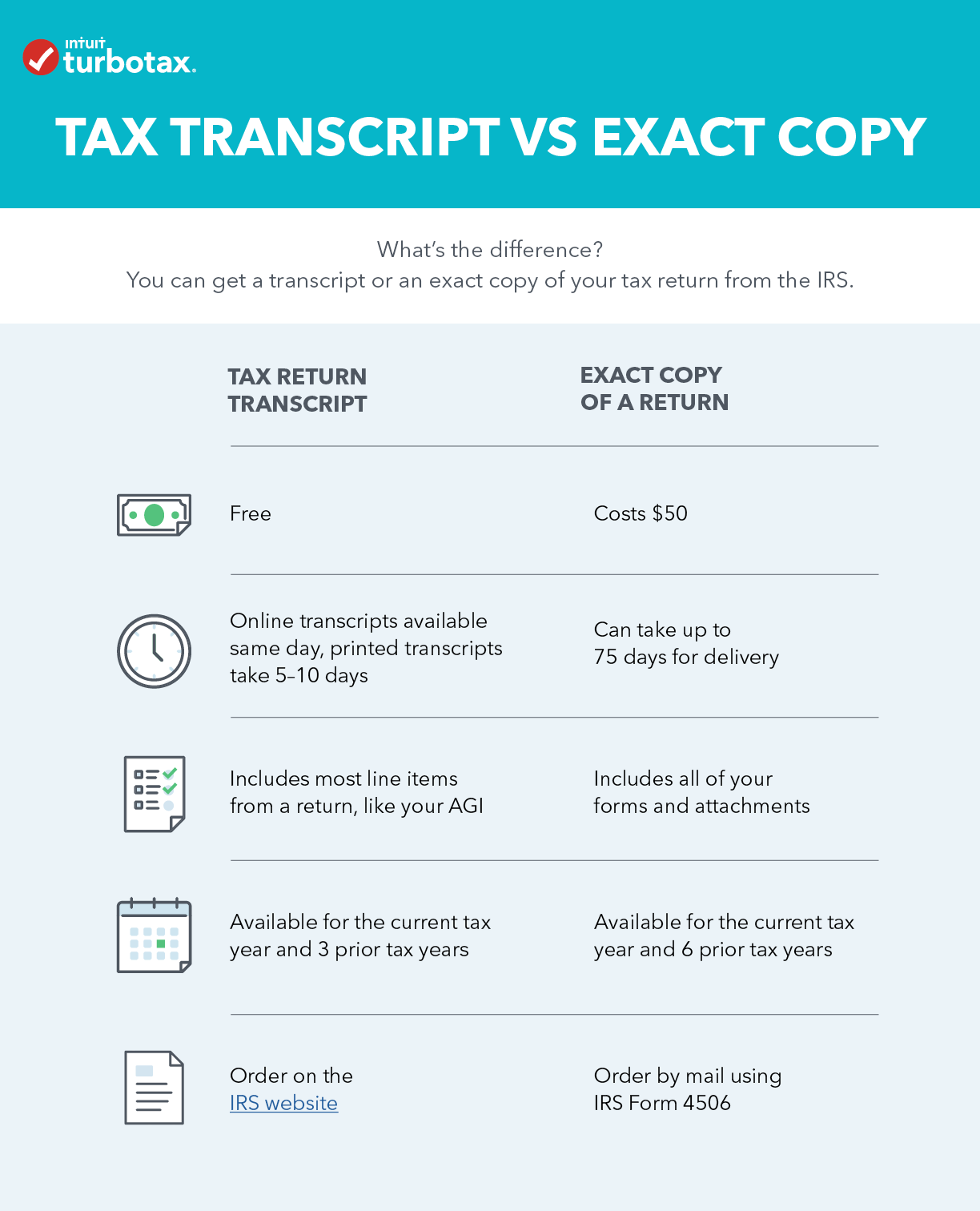

Note: the secondary spouse on a joint return must use Get Transcript Online or Form 4506-T to request this transcript type. This transcript will often be accepted by lending institutions for student loan or mortgage purposes. This shows most items reflected on a taxpayer’s original tax return, including adjusted gross income, and accompanying forms and schedules for the current year and three prior years. This transcript is only available for the current tax year and returns processed during the prior three years. It doesn’t show changes made after you filed your original return.

It shows most items from your return (income, deductions, etc.) as you originally filed it. There are several different kinds of tax transcripts:Ī Tax Return transcript is the one most people need.

#Tax return transcript password

You won’t be able to log in with your existing IRS username and password starting summer 2022. If you have an existing IRS username, you will need to create a new ID.me account as soon as possible.

IRS is bringing an improved sign-in experience. Order copies of tax records including transcripts of past returns, tax account information, wage and income statements and non-filer letters.

0 kommentar(er)

0 kommentar(er)